Market Commentary - 11.6.14 Market Implications of a Divided GovernmentOn election night, Republicans posted impressive gains by taking control of the Senate and adding to their already large majority in the House. The GOP will have at least 52 Senate seats (representing a gain of 7), while in the House, they now have at least 243 seats (a gain of 14). With a Republican Congress and a Democratic President in office for the next two years, what will this mean for the government and investors? While it probably means two years of gridlock that could be a headwind to U.S. economic growth, historically speaking, it has been a positive for stock market returns.

Although the GOP gains did result in a majority in both houses of Congress, without a two-thirds majority in both parts of Congress, Republicans cannot override a Presidential veto. However, their power lies in their ability to set the Senate’s agenda by leading important committees including the budget, finance and energy panels. Each new leader from the Republican Party would potentially bring a markedly different agenda than the Democrats who currently head them. Potential new committee heads have, in the past, criticized recent Democratic initiatives including the Affordable Care Act, the immigration bill, and the medical device tax. We expect discussions around these topics, along with Republican favored initiatives such as a permanent corporate tax rate of 25% (or lower), the Keystone XL pipeline build, and opening the Arctic National Wildlife Refuge for oil drilling to take center stage.

These initiatives are subject to significant debate and will not be passed overnight. As such, we expect some level of gridlock to impact the government. This political gridlock could have economic ramifications. As we noted in our most recent market outlook, government spending seems likely to reverse its recent trend of declining. However, a gridlocked government may limit new initiatives and result in less spending. Likewise, as we have seen in the past, political gridlock may take a toll on business spending, as companies are unsure of when new regulations may appear and, as such, may take a wait and see approach. Reduced government spending coupled with reduced business spending, could negatively impact U.S. economic growth, creating a potential market headwind.

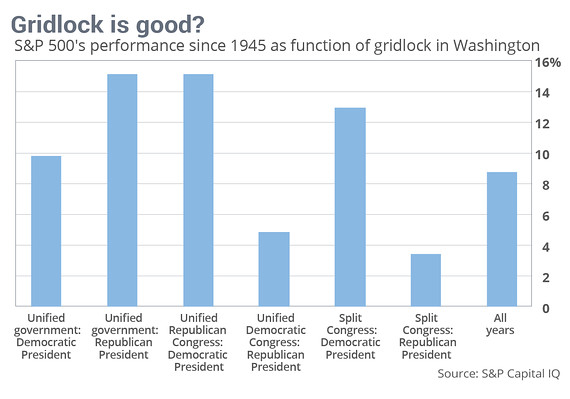

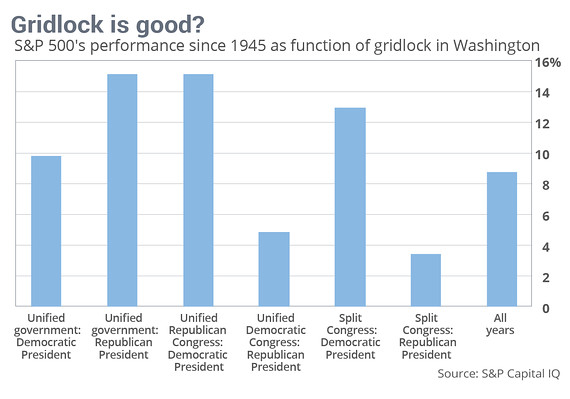

However, while government gridlock can be a headwind to economic growth, there is actually good news for equity investors. As shown in the chart below, S&P Capital IQ notes that the stock market historically has been especially strong under a Democratic president and a Republican Congress. The S&P 500's average return during these periods has been nearly double the index's 8.8% average return for all periods since 1945.

Overall, the mid-term election results created a leadership change in Congress. However, the resultant Republican-led Congress will still not have the requisite two-thirds majority necessary to override a Presidential veto, and the combination of a Democratic President and a Republican Congress will likely lead to some level of political gridlock. Though market returns have historically been solid during these scenarios, one concern is the potential negative impact on U.S. economic growth. This likely headwind may upset the seemingly balanced headwinds (stronger US dollar, weakness in Europe) and tailwinds (low energy prices, strong corporate earnings), and increase market volatility. In periods of elevated volatility, we continue to urge investors to maintain broad diversification and consider the inclusion of income yielding securities, such as corporate bonds relative to Treasuries, as a buffer against market fluctuations.

This information is compiled by Cetera Investment Management.

About Cetera Investment Management

Cetera Investment Management LLC provides passive and actively managed portfolios across five traditional risk tolerance profiles to the clients of financial advisors, who are affiliated with its family of broker-dealers and registered investment advisers. Cetera Investment Management is part of Cetera Financial Group, Inc., which includes Cetera Advisors LLC, Cetera Advisor Networks LLC, Cetera Financial Specialists LLC, and Cetera Investment Services LLC.

About Cetera Financial Group

Cetera Financial Group, Inc. is the cornerstone of the retail advice division of RCS Capital Corporation (RCS Capital) (NYSE: RCAP), which is focused on serving the needs of investors with best-in-class solutions.

Committed to using its collective knowledge and expertise in service to and for others, Cetera Financial Group is focused on the growth of its affiliated broker-dealers and financial professionals' businesses by giving them the industry and market insight, technology, resources and solutions they need to better focus on helping their clients pursue their financial goals. For more information, visit cetera.com.

No independent analysis has been performed and the material should not be construed as investment advice. Investment decisions should not be based on this material since the information contained here is a singular update, and prudent investment decisions require the analysis of a much broader collection of facts and context. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. The opinions expressed are as of the date published and may change without notice. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision.

All economic and performance information is historical and not indicative of future results. The market indices discussed are unmanaged. Investors cannot directly invest in unmanaged indices. Please consult your financial advisor for more information.

Additional risks are associated with international investing, such as currency fluctuations, political and economic instability, and differences in accounting standards.

Affiliates and subsidiaries and/or officers and employees of Cetera Financial Group or Cetera firms may from time to time acquire, hold or sell a position in the securities mentioned herein. |