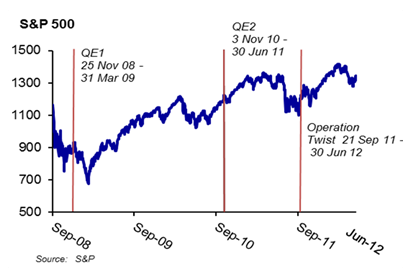

Market Commentary - 8.7.12 What's the Deal about QE3?There is much talk that the Federal Reserve (hereafter "the Fed") may soon implement another major round of stimulus, most commonly referred to as QE3. To understand its potential effects, a little background is needed on what "QE" is and its potential effects. QE3 refers to a potential third round of quantitative easing measures to be implemented by the U.S. central bank. With the Fed sensing that the global growth slowdown threatens to halt the fragile recovery of the American economy, Fed policy makers are again considering buying long-term assets from banks in an attempt to lower long-term interest rates, thereby increasing excess reserves in banks, which in turn should encourage confidence through increased lending. Ultimately, increased lending should spur economic growth.  Key takeaways from the Fed's August 1st FOMC policy statement make it more likely that the central bank may implement strong QE measures at their next September 12-13 meeting, unless employment data meaningfully improves. Another factor leading to this view is that the September FOMC meeting follows the Kansas City Fed's annual global central banker Jackson Hole Economic Policy Symposium on August 31st through September 1st. The event has been used in the past to discuss potential monetary policy moves. As several market strategists observe, the Fed's mandate for full-employment suggests that the FOMC's expected QE3 action may involve the Fed making structured purchases of mortgage-backed securities (MBS) as opposed to Treasuries, thereby encouraging further recovery of the housing market. Regardless of form, the outlook argues for continued investor exposure to equities, with a preference for quality dividend-paying stocks. An exposure to commodities also makes sense, given their attractive valuations stemming from a potentially QE3 weakened US dollar. Additionally, higher-yielding corporate bonds are also particularly attractive. As always, we advocate investors keep their portfolios well diversified. This information compiled by Cetera Financial Group is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. The information has been selected to objectively convey the key drivers and catalysts standing behind current market direction and sentiment. No independent analysis has been performed and the material should not be construed as investment advice. Investment decisions should not be based on this material since the information contained here is a singular news update, and prudent investment decisions require the analysis of a much broader collection of facts and context. All economic and performance information is historical and not indicative of future results. Investors cannot invest directly in indices. This is not an offer, recommendation or solicitation of an offer to buy or sell any security and investment in any security covered in this material may not be advisable or suitable. Please consult your financial professional for more information. |

KEY FINANCIAL SERVICES

OPENING THE DOOR TO A BETTER UNDERSTANDING

Contact Us

2400 86TH STREET SUITE 21

URBANDALE, IA 50322

Phone: 515-276-2873

Fax: 515-276-3876

Printed from: www.stephencanakes.com